Contents:

It’s easy to learn and use even without an accounting background”. Many companies have also been implementing the new revenue recognition and lease accounting standards. As part of this journey, many are exploring technology solutions including CCA to automate and optimize. A CCA can facilitate implementation of accounting changes and create significant efficiencies. The best accounting software is not only affordable and feature-rich, but it is also designed to be easy to use.

- The top cloud accounting software is Freshbooks, designed for both business owners and accountants.

- Similarly, as a service-based company, you will need software that will help you track time and invoice billable hours easier.

- The seller first delivers the domain to us, then we send you your tailored transfer instructions.

- The multi-user feature of cloud accounting means you can give different people access to your financial records and bookkeeping process, which they can access remotely.

Set up your bank accounts and import your transactions, set up rules to categorize your banking transactions, and reconcile transactions in moments. All your invoicing and payment information will be automatically synced with the free Wave Accounting software that’s included in your account. The software will give you full control over your purchase orders and enable you to view quantities on hand with advanced inventory management.

How Much Does Accounting Software Cost?

Advanced https://1investing.in/ include double entry, payroll integration, project cost tracking, customization options and the ability to collaborate with an accountant. Wave is a free accounting service that is designed for small businesses just starting out. The easy-to-use software has all the basic features needed to keep your accounting department in order.

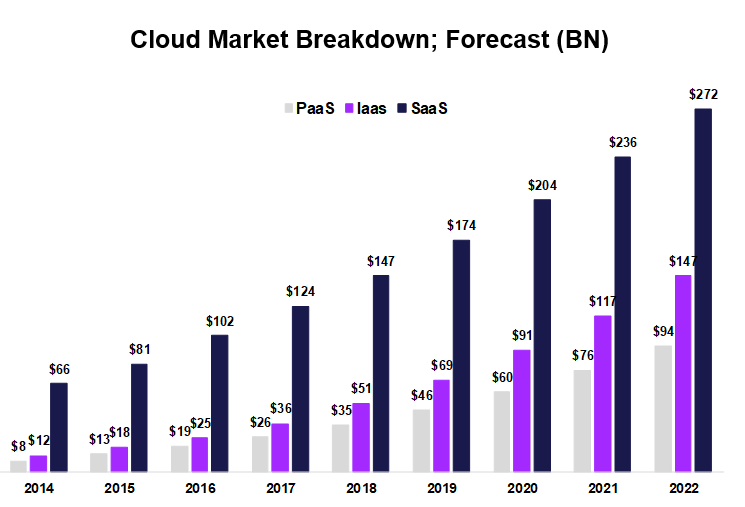

2023-2029 Cloud Accounting Software Market Size Detailed Report … – Digital Journal

2023-2029 Cloud Accounting Software Market Size Detailed Report ….

Posted: Thu, 13 Apr 2023 06:45:48 GMT [source]

Sage Accounting Start is an entry-level accounting software plan ideal for self-employed and microbusinesses that costs $10 per month. It allows one user to create invoices, track payments, accept online card payments and create financial reporting. Advanced features, such as bill tracking, inventory management, quote creation, cash flow forecasts and invoice management, are available on the Sage Accounting plan. The higher tier plan is $25 per month but users get 70 percent off the first six months during the current promotion bringing the cost to $7.50 per month. Neat just has one pricing plan making it easy for business owners who have a hard time deciding on which plan to choose.

What will happen if I don’t adopt cloud-based technologies?

In addition, cloud providers typically position backup servers in two or more sites. This means you would still have access to your data even if one server network malfunctions. Do you know that a number of payment applications can be linked to your invoices and online accounting? Yes, and this allows customers to automatically pay you, thereby fast-tracking payment times and relieving the stress of admin duty on you or your workforce.

The software organizes your workflow and lets you focus on growing your business. To further examine the platform for yourself, it offers a free trial that you can sign up for. AvidXchange is a cloud-based accounts payable software that provides end-to-end invoice management, including payment automation. This software allows you to review, code, and approve payments from a simple and easy-to-use dashboard.

Safety and Security

As the time it takes to process transactions is reduced, both time and cost savings are channeled into business growth initiatives. QuickBooks Online easily integrates with other Intuit applications and other third-party applications such as Shopify and Paypal. To extend the software’s functionalities you may use QuickBooks with Bill.com, Method CRM, and other apps. Paychex utilizes its own voice-activated technology, Paychex Voice Assist, to process your payroll while you focus on other important tasks. What NetSuite ERP provides is a unified view of your business from a single platform that brings together finance, manufacturing, supply chain, ecommerce, and HR in one system. NetSuite ERP can integrate with your existing CRM and web investments and other third-party solutions.

Enterprises can gain a staggering $4.14 billion in net new profits if they can effectively roll out cloud adoption. This specific link between business profit growth and the use of cloud technology is a result of expanding business capacity, unlocking value from data through the use of AI, and fostering collaboration, among others. The flexibility, scalability, and accuracy as delivered by cloud technology promote streamlined workflows that make room for rapid growth. This enables you to streamline your whole business process and cut down on time consuming administrative tasks. This in turn frees up your employees time to focus on more important tasks. This is vital when you’re looking to make big financial and strategic decisions and want access to the most up to date and relevant data.

When a company is first getting started, it may use spreadsheets or other manual systems to manage their general ledger and other accounts. However, this approach is error-prone and cumbersome and often quickly proves unsustainable. In cloud accounting, accountants, controllers, CFOs and other relevant parties receive login credentials for the system and access it through a web browser, whether on a laptop, smartphone or tablet. The provider may also offer a mobile app to improve the user experience on phones and tablets. Cloud-based accounting software is just like traditional accounting software with the exception that all the data is hosted on remote servers instead of the user’s desktop computer. The 100 percent free accounting software is ideal for new small businesses looking for a highly affordable option.

Try it yourself. It’s Free!

After you’ve supplied information about your company structure, one of your next setup tasks will be to add information about your customers and vendors. Some online accounting software lets you include more than basic contact details (“customer since” date, birthday, and other similar fields), which can be helpful as you develop and maintain relationships with them. You do the same thing for the products and services you sell, so you can add them easily to transactions. Companies that use cloud accounting require less initial server infrastructure to store data, and IT staff is not required to maintain it or update the cloud accounting system.

You can use incremental cost-based software from any device with an internet connection. Online accounting software keeps small business owners connected to their data and their accountants. The software can integrate with a whole ecosystem of third-party business apps. Generally, most cloud accounting solutions utilize innovative approaches like encryption and multi-factor authentication, which guarantees the security of sensitive data.

Put simply, a “gateway” that allows different pieces of software to connect with each other. In the case of cloud accounting, an API is necessary to connect third-party software. If you’re still getting your head around the jargon of cloud accounting, here’s our breakdown of some common terms.

Is SAP cloud-based accounting?

AvidXchange comes with a secure SSAE 16 Facility, plus a suite of sophisticated disaster recovery procedures. Dedicated specialists are also accessible 24/7 to provide assistance. The requisition system has a “goods received” feature that helps keep track of all issued POs. This functionality automatically updates the platform, which can be also be forwarded instantly to the ERP system.

Implementing cloud platforms and solutions and related performance management mechanisms. To the extent that companies are implementing a CCA as part of other accounting change initiatives, they should also ensure they have the right processes and governance to address the new CCA standard. Segregate costs for a solution that has multiple components, such as on-premises equipment, cloud solutions, hardware, software and third-party vendors. Here are the metrics we used to evaluate the leading accounting software companies. QuickBooks is a good choice for freelancers and small businesses that need a simple way to track expenses, organize receipts and log mileage.

To assist in addressing these challenges, companies can use this as an opportunity to leverage technology through process automation. Visualization tools can be used to simplify and track the end-to-end process of CCA for data already captured today, or tracked specifically for project purposes. ERP software includes all the features of accounting software, plus additional features such as CRM, inventory management and project management. ERP software is typically used by larger businesses, while accounting software is more suited for small businesses. To determine the best accounting software for small businesses, we reviewed the rates for each and compared the price to its feature set to determine each provider’s value for the price.

One of the easier cloud accounting interfaces to navigate, ZipBooks allows you to create records for contacts and items, send invoices, track time, projects, and tasks. The most cost-effective and time-efficient way of handling accounting is picking the right cloud-based accounting software. Cloud accounting software is often less expensive than on-premises systems because it offloads many expenses to the vendor. There’s no need for the company to purchase hardware or expand its IT staff to monitor and maintain the system. We researched reviews from real users to gauge their opinion of each platform.

For many small businesses, software is the more affordable alternative to hiring an accountant or a large firm to manage their accounting, tax prep and payroll. However, with so many options on the market today, choosing the right solution can be a challenge. To help, we’ve narrowed in on the best options for a wide variety of small businesses.