Contents:

All of the above. During the EasyStep Interview, you can set up a password for which of the following users? Administrator This is the correct answer. QuickBooks assumes the person who is completing the Easy Step Interview is the administrator and only asks for this password.c. External Accountant Only the password for the Administrator can be set during the EasyStep Interview.

The first screen wants to know the name of your company, its legal name, its tax ID, and your contact info. The “Company name” field is the only one that’s required—you can fill in the other fields later on as described on Modifying Company Info. You can click and drag a diamond to move the list entry to a different location on the list.

MASTER QuickBooks 2018 AT SIMONSEZIT.COM

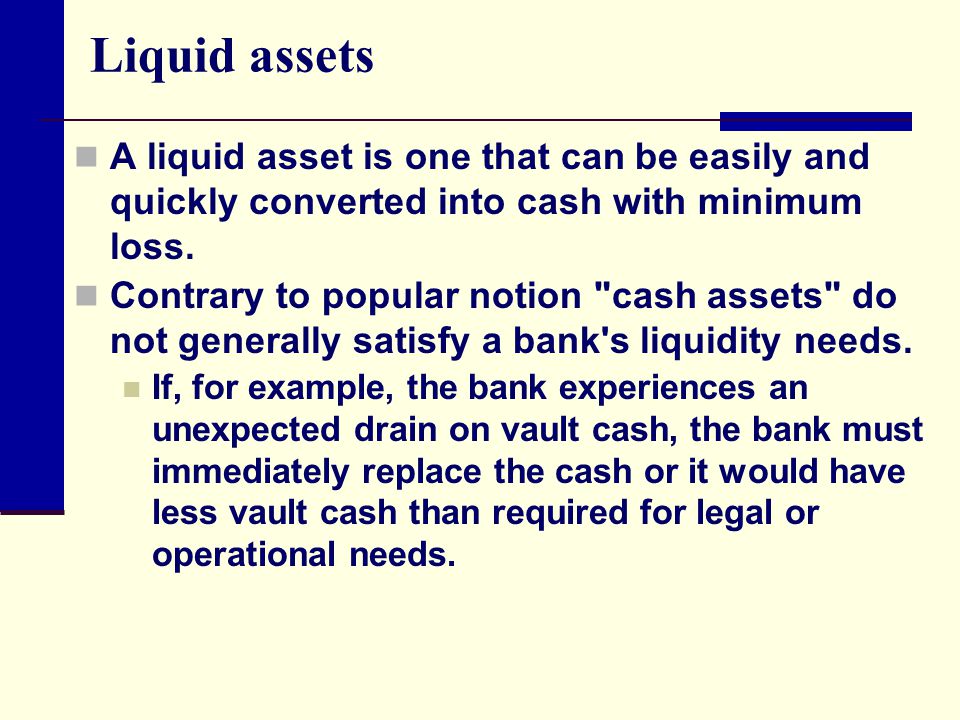

It should always match the opening balance on the paper bank statement. It should always match the original account opening balance when the account was created. The beginning balance changes from month to month when you reconcile. It is in effect the “ending” balance from the month before. The beginning balance should always be zero. This is wrong.

We’ve detected that your browser has JavaScript disabled. Some features of Credly require Javascript to be enabled. For the best experience, please enable JavaScript in your browser settings or try using a different browser. The date you want to begin tracking the company’s finances in QuickBooks.

Adding Details to Your Company File

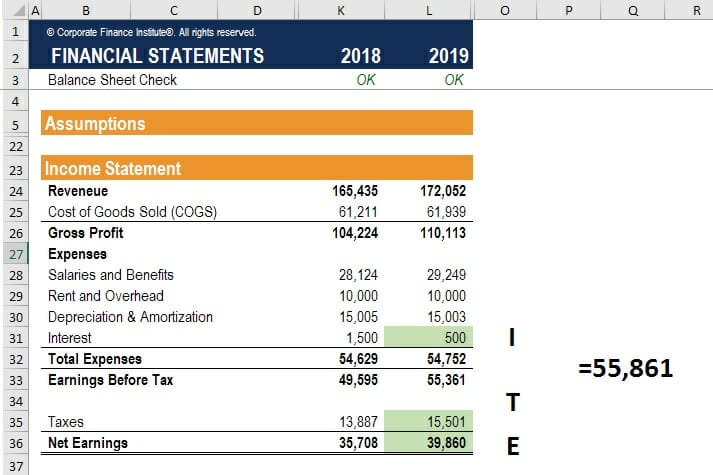

The average collection period formula check, which is preprinted with earnings and taxes columns. They need information in addition to their net pay amount. Have funds in your checking account to cover the payment amount. The Equity and Asset accounts are involved in every transaction. Turn on payroll through your preferences and complete the Payroll Setup Interview.

During the EasyStep Interview, what “Start Date” should you use? There is no Start Date in the EasyStep Interview. There is a Start Date.b. The date the company bought QuickBooks. Tax ID Although there is a field for Tax ID, it is not required to complete the EasyStep Interview.d. All of the above Only one field is absolutely required.

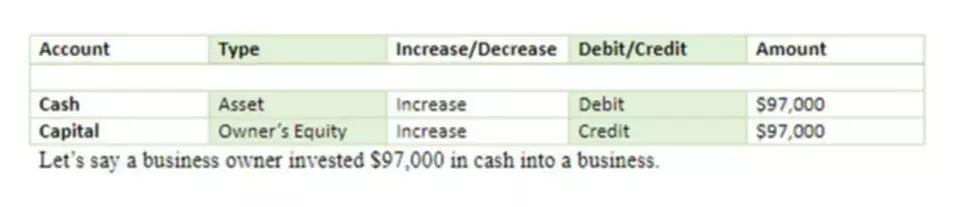

You should only use journal entries if you have a strong accounting background and truly understand debits and credits. Also, you should not use journal entries instead of the built-in forms and windows in QuickBooks. This can create unexpected results on reports. During the EasyStep Interview, how do you setup a new account that is not on the default list of accounts?

- Or perhaps you’re switching from QuickBooks for Mac to QuickBooks for Windows.

- QuickBooks places a checkmark in front of the accounts that are typical for your industry.

- This can create unexpected results on reports.

This will record the purchase twice.b. Write a check, and then mark it as “pending” until you pay it. You can’t do this in QuickBooks.c. Enter a bill, and then use the Pay Bills window. If you enter a bill, you MUST use the Pay Bills window to pay the bill.d. You can’t track accounts payable.

If you moved a list entry up or down, what happens when you add a new entry tothe list? QuickBooks adds new list entries to the bottom of the list, regardless of alphabetic order. QuickBooks doesn’t automatically add entries to the bottom of the list. The new entry automatically goes to the top of the list. QuickBooks adds new list entries in alphabetic order.

Quickbooks-practice-with-answers-and-feedbackbdsb sgagagfnngdn rigskgkosgksog mms ksmgmmg kkfrmbmfh rmldhrd

When you record a bill, you have automatically recorded an Accounts Payable transaction. When would you enter a journal entry? To correct errors This is correct, but so are the other choices.b. For year-end adjustments This is correct, but so are the other choices.c. To enter depreciation This is correct, but so are the other choices.d.

The other entries on this button’s drop-down menu cover the rest of the bases. You can use it to open an existing company file or convert existing records that are in Quicken or another accounting program for use in QuickBooks. Keeping books requires accuracy, attention to detail, and persistence—hence the customary image of spectacled accountants scanning row after row of numbers. QuickBooks can help you keep your books without ruining your eyesight—as long as you start your company file with good information. If you want to practice with QuickBooks, you can experiment with a sample file, as the box below explains.

The tax form you use depends on the type of business entity you have. This drop-down list contains the most common types, from sole proprietorships and partnerships to corporations and nonprofits. When you select a type, QuickBooks assigns the corresponding tax form to your company file.

Figure 1-4. QuickBooks places a checkmark in front of the accounts that are typical for your industry. Click an empty checkmark cell to add an account that the program didn’t select, or click a cell with a checkmark to turn that account off.

How to Create a QuickBooks Desktop Company File?

This category includes fields for your company address, phone number, email address, and website. Fiscal year. (Intuit releases new versions of QuickBooks in October or November each year for just that reason.) But waiting isn’t always feasible.

This option is automatically defaulted to January. Unless you need change this for some reason go ahead and click Next. If the No Company Open window is visible, you can click “Open or restore an existing company” instead. Exchanging Data with Your Bank tells you how to get your QuickBooks bank accounts and your real-world bank accounts talking. The Business Name, Industry, and Business Type boxes are the only ones that QuickBooks requires. After you fill them in, the Create Company button becomes active.

This example uses Quickbooks Pro 2009. You can leave the interview at any time while you are working on it and return to it later, even if you close Quickbooks. But, it is very important to keep in mind that once you have completed the interview, you will not be able to return to it. After that you will use the Preferences screen found under the Edit menu and the Company Information screen found under the Company menu.

And then, navigate to the customers and receivables option and also choose the customer balance details option. It will also provide a layer of extra security against accidental data tempering, i.e., it prevents any changes in the previous year’s tax reporting data. It is required to setup the QuickBooks admin password and then hit on next. At first, you are required to open your QuickBooks Desktop accounting program. You can click on the diamond and move the list entry to a different location on the list.

As you step through the screens in this section, make a list of the features you’re turning on for reference. If you decide to change any of these settings later, Chapter 25 tells you how. The password in both the “Administrator password” and “Retype password” boxes. If you copy and paste the password from one box to the other, you could copy a typo and not be able to open the company file you just created.